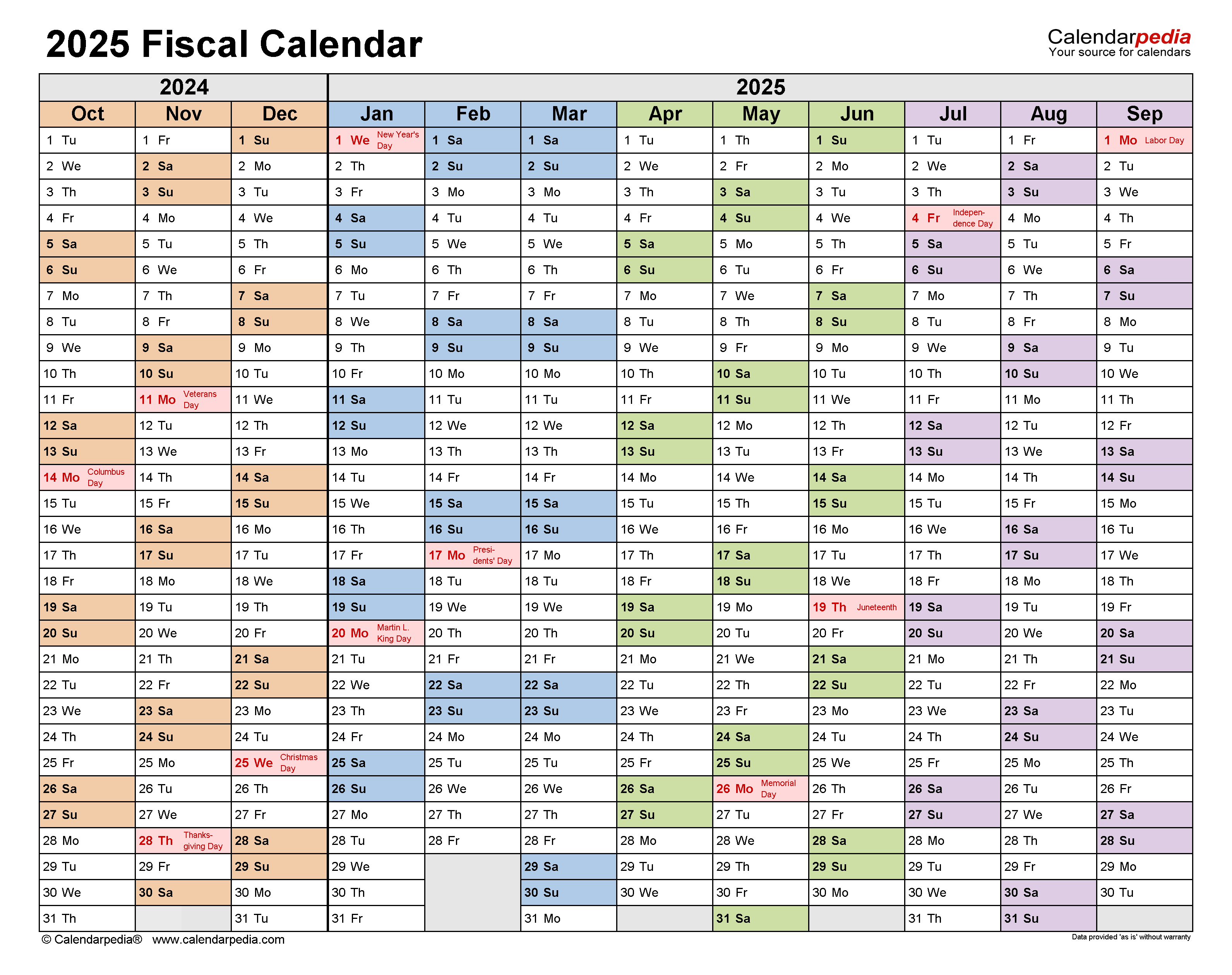

Income Tax Calendar 2025 Holidays

Income Tax Calendar 2025 Holidays – Typically percentage of an individual’s or company’s taxable income, income tax is routinely submitted annually to the government. . Holiday let investors who are higher rate taxpayers will face a cut in the income tax relief on their finance costs as relief will be restricted to just 20% from 6 April 2025 in line with long lets. .

Income Tax Calendar 2025 Holidays

Source : www.calendarpedia.com

Greeting Card Calendar 2025 (25/Pack) Item: #70 6501

Source : www.tangiblevalues.com

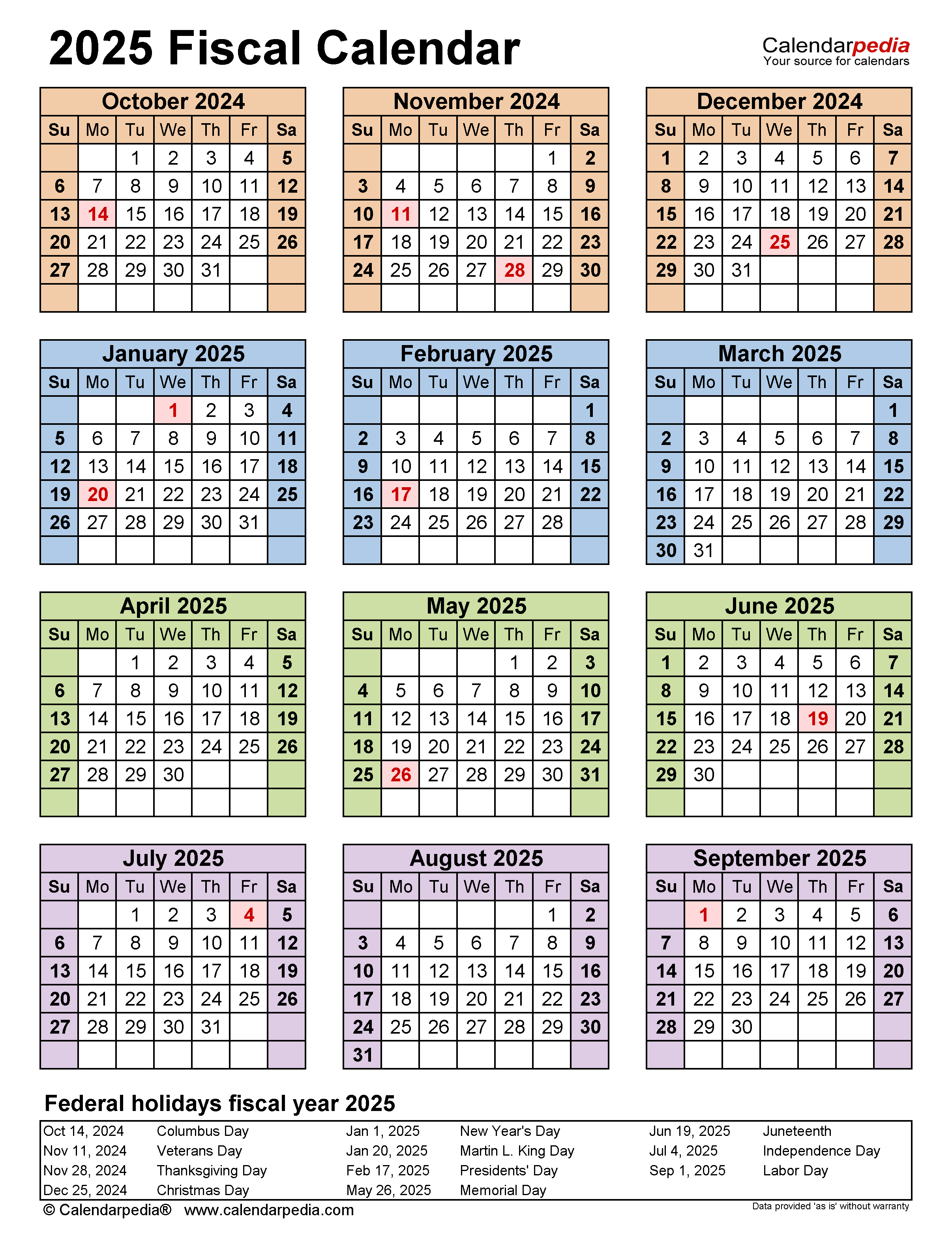

Fiscal Calendars 2025 Free Printable PDF templates

Source : www.calendarpedia.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Fiscal Calendars 2025 Free Printable PDF templates

Source : www.calendarpedia.com

Really Good Stuff® Monthly Calendar Pages 2024 2025 Intermediate

Source : www.discountschoolsupply.com

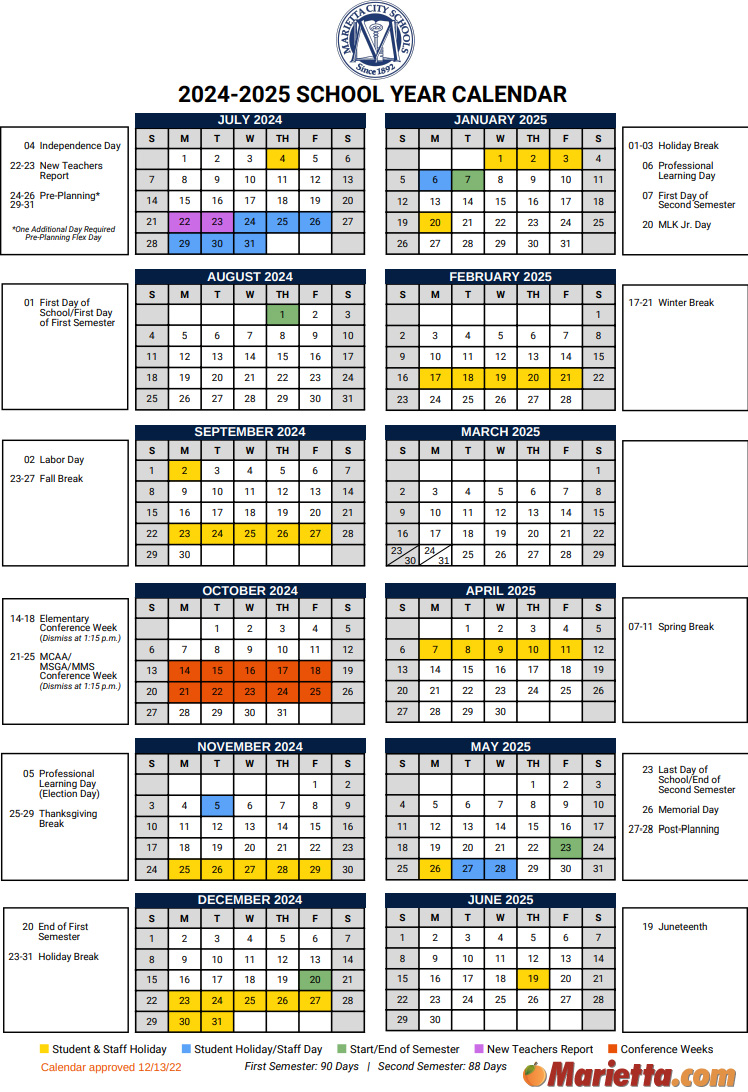

Marietta City School Calendar 2024 2025 | Marietta.com

Source : www.marietta.com

Tax Day 2025 in the United States

Source : www.timeanddate.com

Fiscal Calendars 2025 Free Printable PDF templates

Source : www.calendarpedia.com

SHS 2024 2025 Supply List | Sebring High School

Source : shs.highlands.k12.fl.us

Income Tax Calendar 2025 Holidays Fiscal Calendars 2025 Free Printable PDF templates: Download Income Tax Calculator FY 2024-25 (AY 2025-26) in Excel Format. In the ever-evolving landscape of taxation, staying informed about the latest income tax slabs and efficiently managing your . Tax calculator allows you to calculate taxes based on your income. A person who is in the taxable income bracket has to pay a certain percentage of his or her net annual income as income tax. Income .

Income Tax Calendar 2025 Holidays – Typically percentage of an individual’s or company’s taxable income, income tax is routinely submitted annually to the government. . Holiday let investors who are higher rate taxpayers will face a cut in the income tax relief on their finance costs as relief will be restricted to just 20% from…

Random Posts

- Keurig Advent Calendar 2025 Price

- 2025 Holidays Not Showing In Outlook Calendar App

- Holidays Around The World Calendar 2025

- Fantastic Fungi Wall Calendar 2025 Schedule

- French Revolutionary Calendar 2025

- Canada Advent Calendar 2025

- Match Attax Advent Calendar 24 25 Cake

- Alex Grey 2025 Wall Calendar With Holidays

- Sdsu 2025 2025 Academic Calendar Fall 2025

- October Kindness Calendar 2025 Printable

- Best Days To Deer Hunt 2025 Calendar

- 2025 Checkbook Size Calendar Printable Pdf

- Portland Events Calendar 2025

- Calendar Of June July August 2025

- Charlotte Mecklenburg School Calendar 24 25 Pdf

- Diwali Days 2025 Calendar

- Economic Calendar November 2025 Calendar

- Aafes Pay Calendar 2025

- Fia Wrc Calendar 2025

- Uopeople Academic Calendar 2025 Pdf

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)